By Doug Stephens

This is a just partial list of retailers who have closed or plan to close significant numbers of stores in the near future.

Radio Shack, JC Penney, Sears, Best Buy, Office Max, Staples, Abercrombie & Fitch, Aeropostale, Sam’s Club, Target, Barnes & Noble, Toys R Us, Macy’s

Death By Old Metrics

The common reasoning behind the closures is diminishing same-store productivity. Some are the victims of polarizing economics, some of the Internet and others of intense competition, but whatever the root cause, the net effect has been the same – their stores are not deemed to be “productive” by conventional measures like sales per square foot, sales per operating hour and sales per employee, which is precisely the problem. In a world where e-commerce is now growing globally at close to 20% each year and consumers no longer rely on stores as their sole means of access to product, can we really expect to measure store productivity the same way we did in the mid 1800’s?

And if we do use the same metrics of performance, are we not simply signing the death warrant for physical stores? I think so. I would also contend that retailers that allow this to happen are missing out on an historic opportunity.

From Distribution of Products to Distribution of Experiences

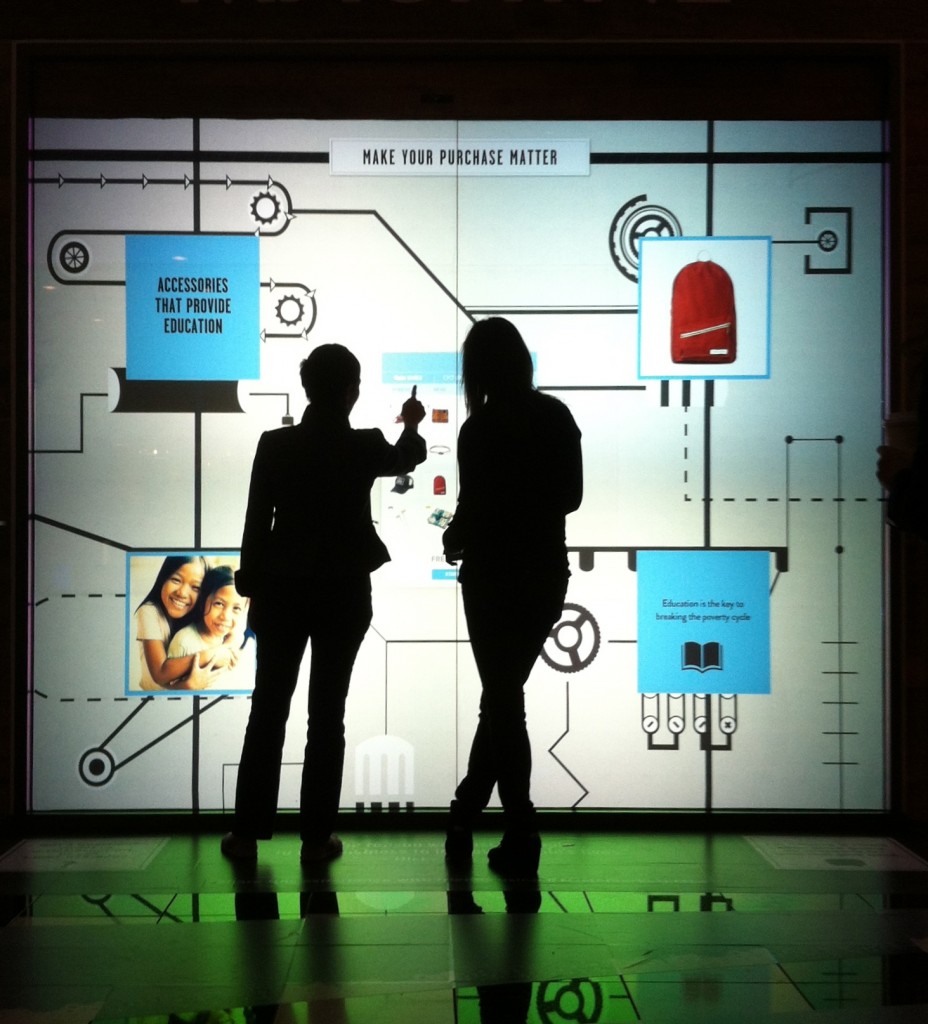

The big shift, you see, is that while stores are ceasing to be vital for the distribution of products they are becoming more profoundly crucial for the distribution of experiences. The store allows the consumer to engage the brand, its products and its culture in a visceral and emotional way that simply cannot be replicated online. Therefore, as more and more sales are attributed to mobile, social and online channels, the store’s strategic importance has to shift to delivering more powerful, galvanizing experiences that forge love and loyalty. In short, the store is becoming a media experience! And if executed properly, I would argue that the physical store experience is most powerful form of media a brand has at its disposal.

New Metrics For A New Era

But if stores truly begin selling experiences, then we need new means of quantifying and qualifying their success and productivity at doing so. That entails using completely new technologies that allow for the measurement of the store as a media form. These may include mobile I.D. tracking to gauge the store’s ability to draw shoppers across their threshold and video analytics to measure dwell times, navigation paths and engagement with different merchandising and product elements of the store. Beacon technology to initiate and measure direct interaction with shoppers in-store and big data analytics to tailor and personalize the experience based on customer history and preferences. In-store social sharing tools that allow shoppers to share their experiences as they happen, along with social media monitoring metrics to quantify downstream buzz about the brand and the experience consumers enjoy in-store. And of course, apps and other opt-in platforms that help connect the offline and online actions of the consumer in order to track product sales resulting after the store experience. The result should deliver a 360-degree view of the store’s performance and value to the brand – beyond simply unit sales out the door.

All of these technologies exist…right now! But retailers need to embrace them and more importantly embrace the paradigm shift they represent; that we can no longer measure retail store productivity based solely on holdover metrics from the industrial age.

Don’t Down-size the Store. Right-size the Experience

It’s also clear that we need to redesign stores to be more effective and  efficient at delivering these high-octane experiences. But (and this is important) that doesn’t necessarily mean that stores should be smaller, like so many retailers seem to believe. In fact. it may mean just the opposite. Consider the work that Verizon did with their lifestyle store in The Mall Of America, creating six different lifestyle zones to allow customers to experience their technology. Look also at the design of Canadian retailer SportChek’s 77,000 square foot store in Canada’s West Edmonton Mall. These weren’t decisions based on making the store smaller or larger but rather on creating a remarkable and differentiated experience.

efficient at delivering these high-octane experiences. But (and this is important) that doesn’t necessarily mean that stores should be smaller, like so many retailers seem to believe. In fact. it may mean just the opposite. Consider the work that Verizon did with their lifestyle store in The Mall Of America, creating six different lifestyle zones to allow customers to experience their technology. Look also at the design of Canadian retailer SportChek’s 77,000 square foot store in Canada’s West Edmonton Mall. These weren’t decisions based on making the store smaller or larger but rather on creating a remarkable and differentiated experience.

Treating the store as media is not to suggest that the goal is no longer to influence product sales. Product sales are key. But clearly the sale of products is no longer strictly tied to the store itself.

In short, the era of the store as the primary distribution channel is rapidly coming to an end. The era of the store as media is upon us. Measure wisely.